The African Development Bank

(AfDB) has warned of deepened economic crisis if Mozambique does not

restructure debt and restore investor confidence.Mozambique’s debt position has

led to a cut in expected growth to 4.5 per cent this year and five per cent in

2020.

“Mozambique’s debt is distressed,

a failure of the debt restructuring agreement and restoring investor confidence

could deepen economic hardship and slow growth,” write AfDB analysts in the

African Economic Outlook, presented today in Abidjan, Côte d’Ivoire.

The outlook further states that

“the strong dependence on debt, mainly domestic, has not only alienated private

investment, but also led to the debt problem”.

Thus “the main policy priorities

should include an active debt management strategy to restore confidence

and…stimulate economic growth and job creation”.

“The main risks to economic

growth include price increases for major imports, such as fuel and food, and

economic hardships in South Africa, the second largest export destination,” the

outlook states.

Last year, economic performance

was expected at 3.5 per cent, “which is a dramatic decline compared to the

average of seven per cent from 2004 to 2015”, warns the AfDB, which attributes

this decrease “to the fall in public investment and a reduction of 23 per cent

in foreign direct investment between 2015 and 2017”.

For this and next year, the Bank

estimates a GDP growth of 3.5 per cent and five per cent, “driven by

agriculture, which continues to recover from the drought of 2015-2016, and by

the extractive industries, with exports of coal to continue to expand”.On

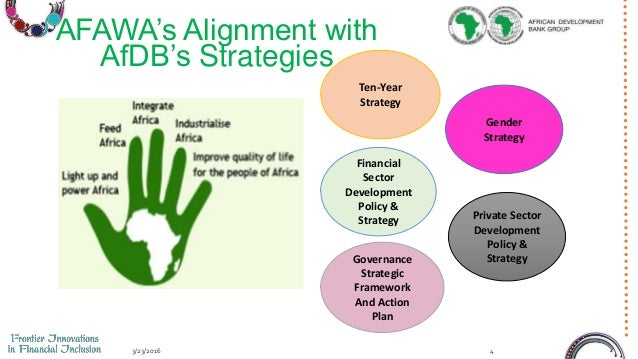

Mozambique, the link between the Bank’s priorities and Government policies is

highlighted.It emphasises that national policies are in line with the five main

priorities of the AfDB, known as High 5: Feed Africa, Industrialize Africa,

Integrate Africa and Improve the Quality of Life, in addition to Lighting

Africa, the latter being the only part where the outlook does not give examples

of measures Mozambique is undertaking.

0 comentários:

Post a Comment