Occidental Petroleum

chief executive Vicki Hollub was caught off guard when U.S. oil giant Chevron

swooped in last month with a $33 billion offer to buy Anadarko Petroleum, the

oil and gas exploration and production firm she had been wooing for nearly two

years. Chevron, nearly five times larger than Occidental, appeared to have

out-manoeuvred its smaller rival. But on Sunday Hollub showed the fight was not

over. After a whirlwind few days to raise more cash, Hollub offered a sweetened

deal. By Thursday, Chevron had bowed out. In edging out Chevron, Hollub leaned

on global relationships and knowledge forged from 35 years in the oil industry,

according to about a dozen people familiar with the talks leading up to the

company’s latest offer.

Hollub knew she

needed to substantially increase the cash offer – thereby making shareholder

approval unnecessary – and moved swiftly to secure it, the sources said. She

was in Paris on April 26, just two weeks after Chevron’s announcement, and

struck an $8.8 billion deal with French major Total SA to sell Anadarko assets

her company didn’t yet own. Two days later she was in Omaha, Nebraska, securing

$10 billion in financing from billionaire investor Warren Buffett’s Berkshire

Hathaway Inc, who typically does not partner with companies pursuing

unsolicited takeovers. Occidental declined to make Hollub available for an

interview for this story. The company’s shares are down 9 percent since making

their offer public in late April. The combined company would establish

Occidental as the largest operator in the Permian basin in west Texas and New

Mexico, the heart of the U.S. shale revolution, where a boom in production has

propelled the United States into becoming the world’s largest oil producer. It

would make Occidental the third-largest U.S. oil company with a market value of

about $80 billion, dwarfed only by global giants Exxon Mobil and Chevron.

“She’s doing the

boldest M&A thing that’s happened since the ‘80s,” said Amy Myers Jaffe,

energy consultant and senior fellow at the Council on Foreign Relations.

“You’re having an atypical M&A battle in a very competitive space where

(usually) the bigger you are, the more you’re going to win.”

Hollub’s challenge

has stunned an industry where the last attempt to break up an agreed-upon deal

between two U.S. oil companies was in 1984 when Texaco challenged Pennzoil’s

acquisition of Getty Oil. It has also angered some Occidental investors who say

Hollub is overstretching the company’s balance sheet in an ill-advised quest

for size in a volatile industry.

“Our concern is the

willingness of the management team at Occidental to cut very favorable deals

against the interests of shareholders on a longer-term basis,” said John

Linehan, portfolio manager at T. Rowe Price. T. Rowe, the sixth-largest holder

of Occidental shares, announced it would vote against the board of directors on

the annual shareholder meeting Friday. But such a move may be mostly symbolic. An

Occidental spokesman declined to comment on the concerns but pointed to

Hollub’s defense of her strategy that it was better to raise cash than issue

new debt. Hollub’s background in the technical aspects of oil production

contrasts with her predecessor, a banker and known deal maker. She has been

described as down to earth by former and current employees, differing from

flamboyant energy CEOs.

“Our concern is the

willingness of the management team at Occidental to cut very favorable deals

against the interests of shareholders on a longer-term basis,” said John

Linehan, portfolio manager at T. Rowe Price. T. Rowe, the sixth-largest holder

of Occidental shares, announced it would vote against the board of directors on

the annual shareholder meeting Friday. But such a move may be mostly symbolic. An

Occidental spokesman declined to comment on the concerns but pointed to

Hollub’s defense of her strategy that it was better to raise cash than issue

new debt. Hollub’s background in the technical aspects of oil production

contrasts with her predecessor, a banker and known deal maker. She has been

described as down to earth by former and current employees, differing from

flamboyant energy CEOs.

Buying Anadarko was

seen as the best way for Occidental to gain more acreage in the Permian shale

basin, where it markets nearly a quarter of all barrels produced in the region.

When Chevron announced a deal on April 12 to buy Anadarko, Hollub gathered the

merger team. They were shocked that Anadarko had accepted a bid that was $11

per share below what Occidental had privately offered, three of the people

familiar with the discussions said.

“She thought, we’re

in it to win it. Let’s make our offer public so their shareholders know what

they passed up,” one of the sources said. In a letter to Anadarko’s board of

directors on April 24, Occidental said they “were surprised and disappointed”

that Anadarko had not agreed to their previous two offers in April. Anadarko

executives, however, remained concerned that Occidental shareholders could

scuttle the deal, leaving them without a buyer, two sources familiar with the

situation said. The board of directors wanted to stick with Chevron. Just two

days after sending the letter, Hollub was in Paris meeting with Total CEO

Patrick Pouyanne to discuss Anadarko’s African assets, according to two sources

familiar with the discussions. The two already had a relationship stemming from

the Dolphin Gas Project, a Middle East cross-border gas initiative where both

companies have an equal share. Total had made it known to her that they coveted

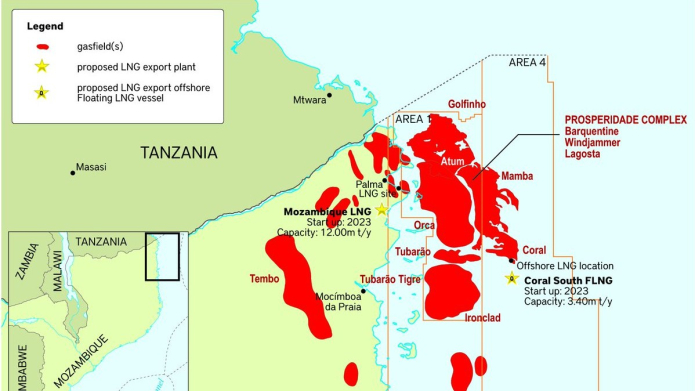

Anadarko’s properties, including a liquefied natural gas project in Mozambique.

“Vicki wanted to

show that she could quickly put the cash on the table. In less than 10 days she

had the cash ready,” a Paris-based source said. Omaha, Nebraska was next.

Buffett is known for moving quickly when a deal piques his interest, but he

tends to avoid getting involved in hostile takeover bids. The meeting was set

up by BofA CEO Brian Moynihan, whose bank was helping to provide financing for

the Anadarko deal. Hollub later said Buffett was “warm and wonderful” in their

meeting, a source familiar with the discussions said. Buffett, cash flush and

on the hunt for new deals, agreed to provide $10 billion in financing in return

for an 8 percent premium, a concern for dividend-focused shareholders who

believe the terms are too pricey. The two deals enabled Hollub to submit a

revised offer on Sunday, increasing the cash component from 50 percent to 78

percent. On Thursday, Chevron said it would collect its $1 billion termination

fee and walk away from the negotiations.

0 comentários:

Post a Comment