ANARDARKO CAPITAL GAINS TAX PAID

The US oil and gas company Anadarko has paid the

Mozambican treasury 520 million dollars in capital gains tax, the chairperson

of the Mozambican Tax Authority, Rosario Fernandes, announced at a Tuesday

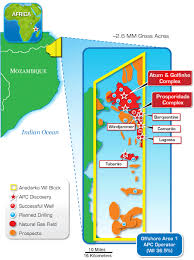

press conference.The Anadarko Mozambican subsidiary, Anadarko Mocambique Area 1

Limited, used to own 36.5 per cent of the Rovuma Basin Offshore Area One, in

northern Mozambique, where vast quantities of natural gas have been discovered.Anadarko

sold ten per cent of these shares to the Indian company ONGC Videsh for 2.64

billion dollars. Fernandes said the capital gain on this deal was calculated at

1.625 billion dollars. The capital gains tax owing, at the standard rate of 32

per cent, was 520 million dollars, and this sum was paid on 13 March.“The AT is thus bringing to the knowledge of the public that this transaction

has been closed”, Fernandes said. “The AT repeats that it will always be firmly

committed to pursuing actions in compliance with Mozambican tax legislation,

concerning capital gains transactions, in close partnership with all the

relevant bodies”.Capital gains tax on transactions involving Mozambican assets

has now become a major source of revenue for the state budget. Cited in

Wednesday’s issue of the independent daily “O Pais”, Fernandes said that, since

2012, there had been five large capital gains tax payments (including

Anadarko’s), amounting to a total of 1.3 billion dollars.He thought this sum

could be doubled by the end of this year, since the AT hopes to conclude by

December the collection of tax from seven multinationals who have sold holdings

in Mozambican coal and natural gas operations. A further three, more complex

transactions should be concluded in 2015. Fernandes did not name which

companies are involved.One he did name was the Australian mining company

Riversdale, which was taken over by Rio Tinto in 2011, for 3.6 billion dollars.

Riversdale’s only assets worth mentioning were in Mozambique – notably the open

cast coal mine at Benga, in the western province of Tete, which is now being

operated by Rio Tinto. No tax whatsoever was paid to Mozambique

on this sale, but Fernandes said the AT intends to pursue the matter “to the

final consequences”.“The Riversdale operation is not something we have

abandoned and it never could be”, he said. “The Riversdale-Rio Tinto operation

is a tax dispute, and we expect to have results. Taxation is a legal

imperative. So the operation remains on the table and we shall follow it to the

end”.It is believed that capital gains tax on the Riversdale deal should bring

at least 200 million dollars into the Mozambican treasury.

The US oil and gas company Anadarko has paid the

Mozambican treasury 520 million dollars in capital gains tax, the chairperson

of the Mozambican Tax Authority, Rosario Fernandes, announced at a Tuesday

press conference.The Anadarko Mozambican subsidiary, Anadarko Mocambique Area 1

Limited, used to own 36.5 per cent of the Rovuma Basin Offshore Area One, in

northern Mozambique, where vast quantities of natural gas have been discovered.Anadarko

sold ten per cent of these shares to the Indian company ONGC Videsh for 2.64

billion dollars. Fernandes said the capital gain on this deal was calculated at

1.625 billion dollars. The capital gains tax owing, at the standard rate of 32

per cent, was 520 million dollars, and this sum was paid on 13 March.“The AT is thus bringing to the knowledge of the public that this transaction

has been closed”, Fernandes said. “The AT repeats that it will always be firmly

committed to pursuing actions in compliance with Mozambican tax legislation,

concerning capital gains transactions, in close partnership with all the

relevant bodies”.Capital gains tax on transactions involving Mozambican assets

has now become a major source of revenue for the state budget. Cited in

Wednesday’s issue of the independent daily “O Pais”, Fernandes said that, since

2012, there had been five large capital gains tax payments (including

Anadarko’s), amounting to a total of 1.3 billion dollars.He thought this sum

could be doubled by the end of this year, since the AT hopes to conclude by

December the collection of tax from seven multinationals who have sold holdings

in Mozambican coal and natural gas operations. A further three, more complex

transactions should be concluded in 2015. Fernandes did not name which

companies are involved.One he did name was the Australian mining company

Riversdale, which was taken over by Rio Tinto in 2011, for 3.6 billion dollars.

Riversdale’s only assets worth mentioning were in Mozambique – notably the open

cast coal mine at Benga, in the western province of Tete, which is now being

operated by Rio Tinto. No tax whatsoever was paid to Mozambique

on this sale, but Fernandes said the AT intends to pursue the matter “to the

final consequences”.“The Riversdale operation is not something we have

abandoned and it never could be”, he said. “The Riversdale-Rio Tinto operation

is a tax dispute, and we expect to have results. Taxation is a legal

imperative. So the operation remains on the table and we shall follow it to the

end”.It is believed that capital gains tax on the Riversdale deal should bring

at least 200 million dollars into the Mozambican treasury.

0 comentários:

Post a Comment