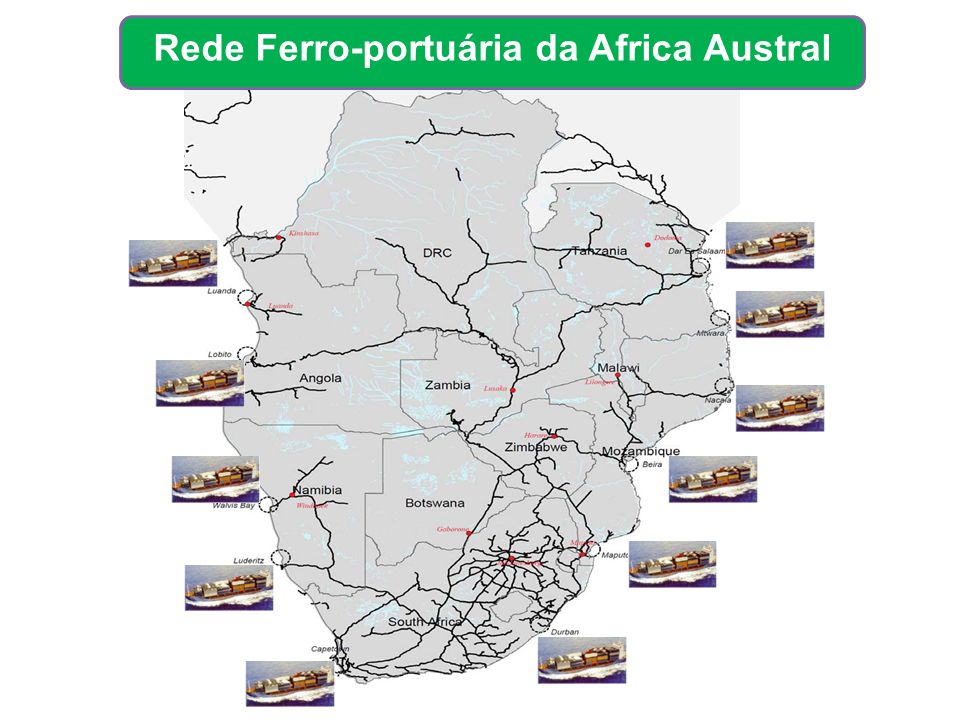

The Port of Maputo in Mozambique has excellent

development potential. It is located along the east coast of Southern Africa,

to the north of the Ports of Durban and Richards Bay. It is one of several ports

that connect via road and railway line to South Africa’s mega-metropolis of

Johannesburg that is still Africa’s leading financial hub.Roads and railway

lines from ports of Maputo, Durban, Richards Bay, East London and Port

Elizabeth cross over and pass through tunnels of the extensive and high

elevations of Dragon Mountain (Drakensberg). Maputo offers the shortest railway

distance to Johannesburg and so could be further developed at lowest cost.

The Port of Maputo in Mozambique has excellent

development potential. It is located along the east coast of Southern Africa,

to the north of the Ports of Durban and Richards Bay. It is one of several ports

that connect via road and railway line to South Africa’s mega-metropolis of

Johannesburg that is still Africa’s leading financial hub.Roads and railway

lines from ports of Maputo, Durban, Richards Bay, East London and Port

Elizabeth cross over and pass through tunnels of the extensive and high

elevations of Dragon Mountain (Drakensberg). Maputo offers the shortest railway

distance to Johannesburg and so could be further developed at lowest cost.

Challenge at Durban

While South Africa has plans to expand Africa’s

busiest container port, the Port of Durban, there has been much public

opposition from groups of Durban residents to future port expansion. Durban has

also experienced the ongoing problem of silt/sand build up at the port entrance

that has a nominal depth of 12.8 meters (42 feet). This may be its natural

depth caused the combination of the south flowing ocean current and wave action

that stirs up sand to the north of the northward pointing entrance to the port.

The entrance to the 20 meter (66 foot) deep Richards Bay is perpendicular to

the ocean current.The overland connection between Durban and Johannesburg

operates near capacity and upgrading the railway line with its multiplicity of

tunnels is both a costly and formidable undertaking. While some containers from

overseas may arrive near Port Elizabeth, the overland distance to Johannesburg

is extensive.It may cost less to upgrade and develop the railway line between

Maputo and Johannesburg to double track than to redevelop the Durban –

Johannesburg line. There may even be scope to explore the possible future

operation of super-wide railway container technology that straddles over double

track railway lines, to increase the number of containers trains carry.

Unexpected Mega Ships

When expansion of the Panama Canal was first

evaluated, the largest container ships entering service carried some 12,000 TEU

and were to be later dubbed neo-Panamax ships. At the time, South Africa

evaluated the logistics of developing a transshipment port for neo-Panamax

ships near Port Elizabeth, where ships sailing to and from East Africa, West

Africa, South America and Asia would converge. Then the unexpected happened

when Maersk began to explore the possibility of a container ship built to a

much larger scale than the neo-Panamax ships and capable of sailing through the

Suez Canal between Europe and Asia.The superior economics of the larger

container ship made the concept attractive on the trans-Pacific services

between Asia and the west coast of North America. Several major ports

internationally were dredged and modified to berth the mega-ships and articles

appeared suggesting that such ships could operate the South America –Asia

service, sailing via Southern Africa. Plans were subsequently announced to

dredge Port of Santos and the develop Port of Pecem located on the northern

outskirts of Fortaleza, Brazil that could serve as a transshipment port for smaller

ships that could connect to South American and Africa ports.

Revising the Logistics

The development of South American ports for mega-size

container ships creates and uncertain future for South Africa’s transshipment

port for neo-Panamax size of container ships. Mega-size ships that sail via

Southern Africa between South America and Asia can be built to a larger size

than Suezmax container ships, perhaps up to 26,000 or 27,000 TEU and even

extend the range of operation between South America and Western Europe.One

option is that future mega-ships that sail the Western Europe – Brazil – Asia

service sail by South African ports while another option would be to

investigate future prospects at Port of Maputo.South Africa’s second largest

city is Cape Town which is the closest South African port to the sea route that

mega-size container ships would sail between Asia and South America. Sections

of Table Bay just outside the port area are 15.6 meters (51 feet) deep. The

combination of dredging Table Bay and either extending the present breakwater

or building a new breakwater could provide a deep water zone for mega-ships.

Deep dredging a section of the port plus some port reconstruction could provide

a quay to berth mega-size container ships that would undergo partial unloading

and partial loading at Cape Town.

The development of South American ports for mega-size

container ships creates and uncertain future for South Africa’s transshipment

port for neo-Panamax size of container ships. Mega-size ships that sail via

Southern Africa between South America and Asia can be built to a larger size

than Suezmax container ships, perhaps up to 26,000 or 27,000 TEU and even

extend the range of operation between South America and Western Europe.One

option is that future mega-ships that sail the Western Europe – Brazil – Asia

service sail by South African ports while another option would be to

investigate future prospects at Port of Maputo.South Africa’s second largest

city is Cape Town which is the closest South African port to the sea route that

mega-size container ships would sail between Asia and South America. Sections

of Table Bay just outside the port area are 15.6 meters (51 feet) deep. The

combination of dredging Table Bay and either extending the present breakwater

or building a new breakwater could provide a deep water zone for mega-ships.

Deep dredging a section of the port plus some port reconstruction could provide

a quay to berth mega-size container ships that would undergo partial unloading

and partial loading at Cape Town.

Options for Maputo

Sections of Port of Maputo were dredged from 9.8

meters (32 feet) to over 14 meters (46 feet). However, unlike Port of Durban

that has no river flowing into the port area, several rivers flow into Maputo

Bay and could carry sand/silt into the port. There may be future need to

install deflector barriers along some sections of some rivers to redirect the

silt toward the river banks, from where local industries may excavate the silt

for use in construction or sent to farms.

A rock breakwater northeast of the

port area may be able to deflect the sand laden ocean current toward ocean.At

present, the DP Ports container terminal is 300 meters (984 feet) in length.

The combination of lengthening the quay to over 400 meters (1,312 feet) and

dredging the channel between the container terminal and deeper water at Maputo

Bay would enhance prospects for mega-size container ships to call at Port of

Maputo while sailing between South America and Asia. These ships would undergo

a partial unloading and reloading of containers to/from the Greater

Johannesburg area.Further development of the Port of Maputo could make it

suitable for transshipment of containers involving smaller ships that would

connect to Kenyan and Tanzanian ports.

Conclusions

There has been public opposition at Durban to

expanding Africa’s busiest container terminal. The overland connection between

Durban and Johannesburg is operating at capacity, with a massive projected

future increase in container traffic along this link.Within the next few years,

mega-size container ships will sail between Asia and South America, with a

possible port of call in Southern Africa. Port of Maputo has prospects for

future expansion and future development of the container terminal to berth

larger ships after the quay is extended and navigation channel dredged to

greater depth.Port of Maputo could require future breakwaters to limit future

silt build up.The comparatively short railway line between Maputo and the

Pretoria – Johannesburg area would cost less to upgrade than the railway lines

extending inland from Durban, East London and Port Elizabeth.While Cape Town

has potential for future development to berth mega-size container ships,

perhaps such development would occur after development of Port of Maputo.

There has been public opposition at Durban to

expanding Africa’s busiest container terminal. The overland connection between

Durban and Johannesburg is operating at capacity, with a massive projected

future increase in container traffic along this link.Within the next few years,

mega-size container ships will sail between Asia and South America, with a

possible port of call in Southern Africa. Port of Maputo has prospects for

future expansion and future development of the container terminal to berth

larger ships after the quay is extended and navigation channel dredged to

greater depth.Port of Maputo could require future breakwaters to limit future

silt build up.The comparatively short railway line between Maputo and the

Pretoria – Johannesburg area would cost less to upgrade than the railway lines

extending inland from Durban, East London and Port Elizabeth.While Cape Town

has potential for future development to berth mega-size container ships,

perhaps such development would occur after development of Port of Maputo.