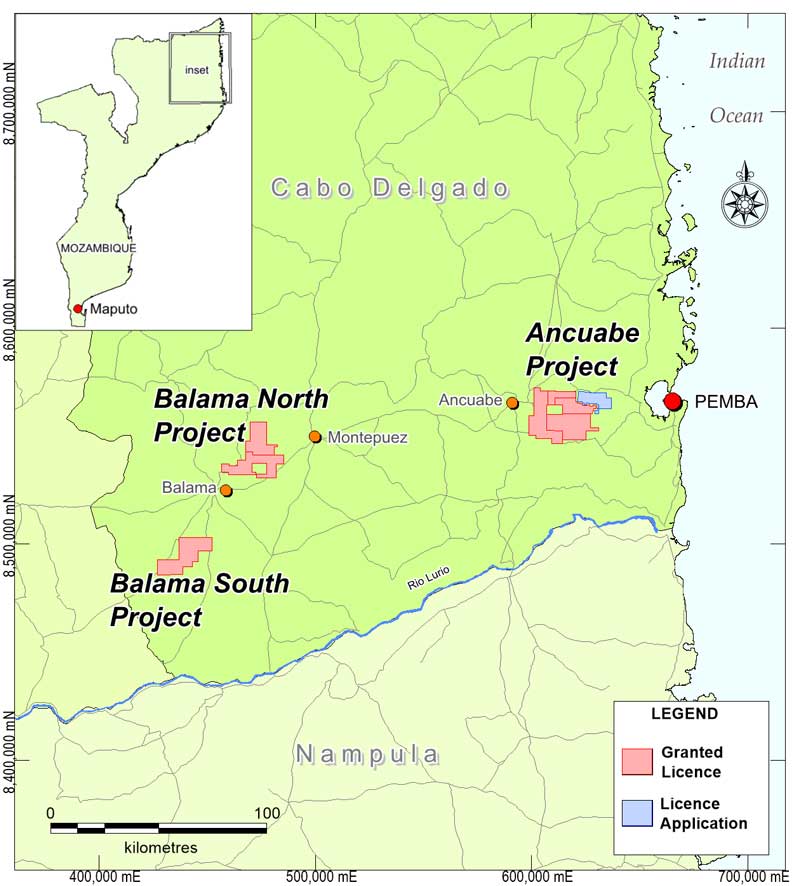

Triton Minerals may in the near future be one of the

hottest graphite investments in Africa. Full-scale construction at its 100%

owned, Mozambique-based Ancuabe graphite project is scheduled to start in April

2020. This will unlock a large flake, high purity deposit that will benefit

from the imminent shortfall in Chinese production of expandable graphite

material, MD Peter Canterbury tells Laura Cornish.

“Shandong is historically the only large-flake

graphite producer in China and is expected to see significant drops in graphite

production as their assets age and mines are closed due to environmental

impacts which the government are looking to reduce,” Canterbury explains.

As such, Triton Minerals has already secured off-take

agreements for 52% of its production with companies in the Chinese Province.

Ancuabe will at full capacity produce 60 000 tpa of

graphite material, which may seem small but is in fact on the larger size of

graphite production Canterbury confirms. At this rate, the mine will operate

for 28 years although the MD notes there is a substantial 49 Mt resource which

once converted could either ramp up the facility’s operating rate or

drastically increase the project’s lifespan. The deposits (there are two that

will be mined for now) have a 6.6% total contained graphite (TCG) content –

which although not the highest is still significant, especially when taking the

unchallenging mineralogy and geological setting into account.

“Importantly, we have determined a four-year payback

on the project and a 37% IRR,” Canterbury highlights. With the project fully

permitted and the necessary investment in place, Triton Minerals is set to move

into full-scale construction on the project in April 2020 (onsite early works

had previously commenced). “We have planned for a 15-month construction period

which will take us to July 2021 to produce our first graphite.” Diversified

Chinese state-owned enterprise MCC International is the appointed EPC

contractor, and will be supported by an owner’s team from South Africa-based

Lycopodium ADP. MCC International is based in Beijing with business units

spanning natural resources, manufacturing, equipment fabrication and real

estate. In 2015, the company merged into China Minmetals to become China’s largest

mining company. The group has a number of complementary proficiencies including

engineering and civil construction. In addition, MCC has strong relationships

with major Chinese banks and has introduced Triton Minerals to potential

financiers, one of whom has provided a loan facility which will fund up to 85%

of the EPC contract at competitive concessional rates. Through the EPC tender

process, Triton Minerals was able to flag potential pre-production capex

savings of 10 to 15% on the US$99.4 million DFS estimate to around $85 million.

Returning to the project itself, Canterbury explains

that Ancuabe will comprise two pits – the T16 deposit and then later on the T12

deposit – situated just 3 km apart. “With our graphite situated no deeper than

130 m, the deposits will be open cut, drill and blast operations. The material

will be transported to a ROM pad which will be followed by three crushing

stages after which it will be moved into a temporary holding bin, ready for

processing.” A 1 Mtpa mill will start the process after which flotation and up

to four stages of cleaning (vertical attrition, separation of large flakes)

will take place. Waste thickening will follow after a filtration circuit. The

filtered material will be kiln dried and then bagged into three or four

different size fractions in 1 m³ bags which will be transported from site to

the port to be containerised and shipped.

Logistically, Ancuabe has no challenges. Its water and

electricity needs pose no difficulties either. The government has granted

Triton Minerals approval to build a 1.5 million cubic litre dam which should

fill within a month of the rainy season onset. Situated close to the processing

plant, the dam will provide all of Ancuabe’s process water needs. “We will also

benefit financially from a 110 kVa power line that runs through our tenement

after it has been upgraded in 2022.” Until then, an 8.5 MW containerised diesel

power plant will fuel Ancuabe’s power needs. Last, but not least, Triton

Minerals is looking to employ around 200 people on a full-time basis once

construction is complete – most of which will be Mozambique residents. The

workforce will peak at about 500 during the mine’s construction period. “With

50% of our product already secured by end users, and the necessary funding in

place to take Ancuabe through to production, we believe we are a stand-out

graphite junior and are positioned to soon move from developer to producer. “In

doing so we will deliver value through returns which will give us the

optionality of returning cash to our shareholders through dividends or

developing the additional assets in our portfolio,” Canterbury concludes.

Logistically, Ancuabe has no challenges. Its water and

electricity needs pose no difficulties either. The government has granted

Triton Minerals approval to build a 1.5 million cubic litre dam which should

fill within a month of the rainy season onset. Situated close to the processing

plant, the dam will provide all of Ancuabe’s process water needs. “We will also

benefit financially from a 110 kVa power line that runs through our tenement

after it has been upgraded in 2022.” Until then, an 8.5 MW containerised diesel

power plant will fuel Ancuabe’s power needs. Last, but not least, Triton

Minerals is looking to employ around 200 people on a full-time basis once

construction is complete – most of which will be Mozambique residents. The

workforce will peak at about 500 during the mine’s construction period. “With

50% of our product already secured by end users, and the necessary funding in

place to take Ancuabe through to production, we believe we are a stand-out

graphite junior and are positioned to soon move from developer to producer. “In

doing so we will deliver value through returns which will give us the

optionality of returning cash to our shareholders through dividends or

developing the additional assets in our portfolio,” Canterbury concludes.

0 comentários:

Post a Comment